change in working capital formula dcf

Web Working Capital Formula. Changes 2017 AR 2016 AR 2017 Inventory 2016 Inventory 2017 AP 2016 AP Where.

Changes In Net Working Capital Step By Step Calculation

Working Capital Current Assets Current Liabilities.

. On the Cash Flow Statement the Change in Working Capital is defined as Old Working Capital New Working Capital where. Web Changes in Net Working Capital Working Capital Current Year Working Capital Previous Year Or Change in a Net Working Capital Change in Current Assets Current Assets Current assets refer to those short-term assets which can be efficiently utilized for business operations sold for immediate cash or liquidated within a year. The entire intuition behind CA-CL is to arrive at how cash has.

A company can increase its working capital by. Say 5 then this will be 6k of your profits so you add 80k to the price 168 million plus the tax of. Debt and Interest-Bearing Liabilities.

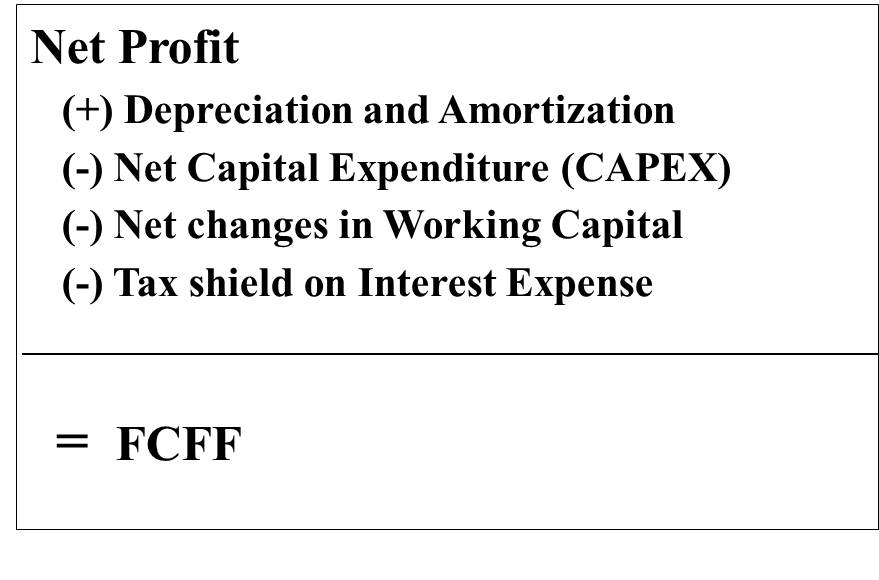

Web Change in working capital basically tells how much has the working capital changed as compared to last year. Web The Change in Net Working Capital NWC section of the cash flow statement tracks the net change in operating assets and operating liabilities across a specified period. Web Free Cash Flow Formula.

It still counts as cash that is tied into running the day to day operations of the business. Web you include change in cash as a part of change in overall working capital. Invested Capital Fixed Assets Net Working Capital NWC.

Web Because the change in working capital is positive it should increase FCF because it means working capital has decreased and that delays the use of cash. When you use the lower number for changes in working capital and. It is not possible that the items will stay the same throughout the.

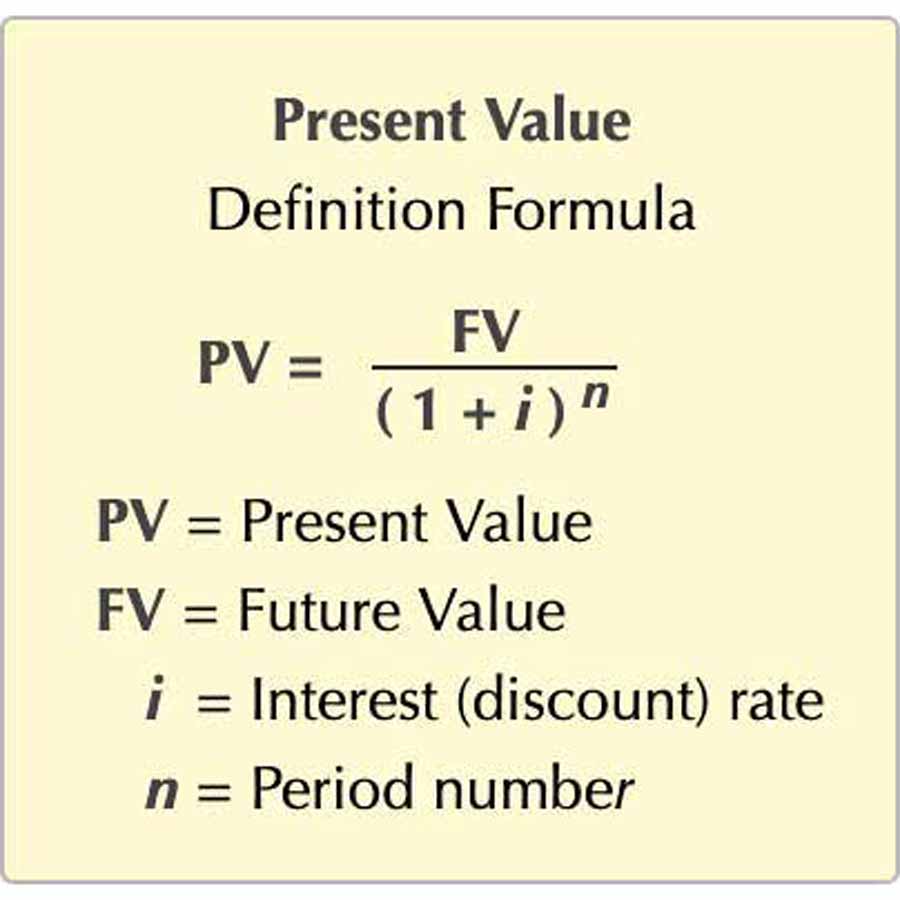

Web The change in net working capital formula is given as N E B where E is ending net working capital and B is beginning NWC. Cash. The net working capital NWC metric reflects the amount of cash tied up in a companys operations.

Web Plus tax on profits from investment portfolio also gets added to the capital. Cash on hand varies for different. Web Change in Working Capital Summary.

By contrast the net working capital NWC metric is similar but deliberately excludes two line items. Web Thus the formula for changes in non-cash working capital is. Web Below is an example balance sheet used to calculate working capital.

Web In this case the change in working capital is computed using the formula above and it is dramatically less. Example calculation with the working capital formula. Web The formula for working capital is current operating assets minus current operating liabilities.

The formula for fixed cost can be calculated by using the following steps.

Net Working Capital Guide Examples And Impact On Cash Flow

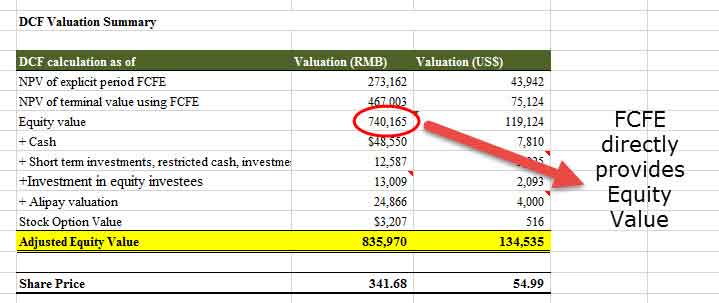

Fcfe Calculate Free Cash Flow To Equity Formula Example

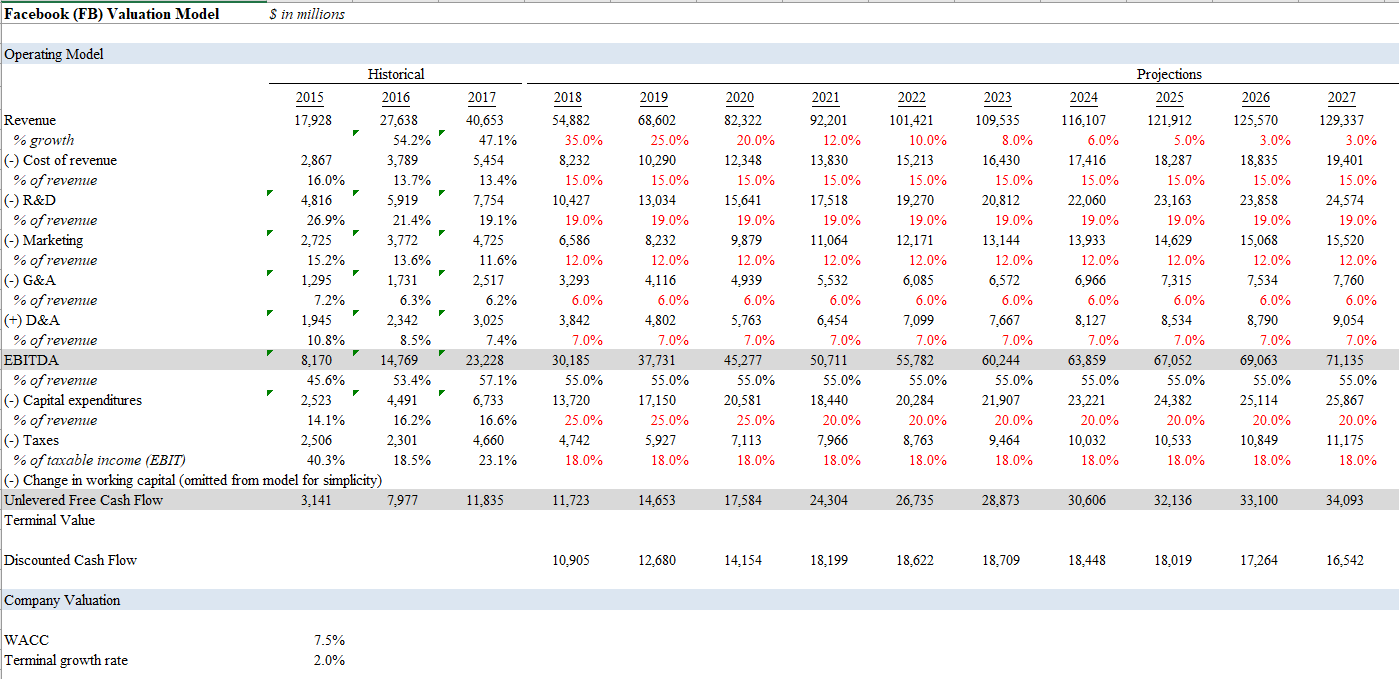

Dcf Model The Complete Guide To Building A Discounted Cash Flow Model

Change In Net Working Capital Nwc Formula And Calculation

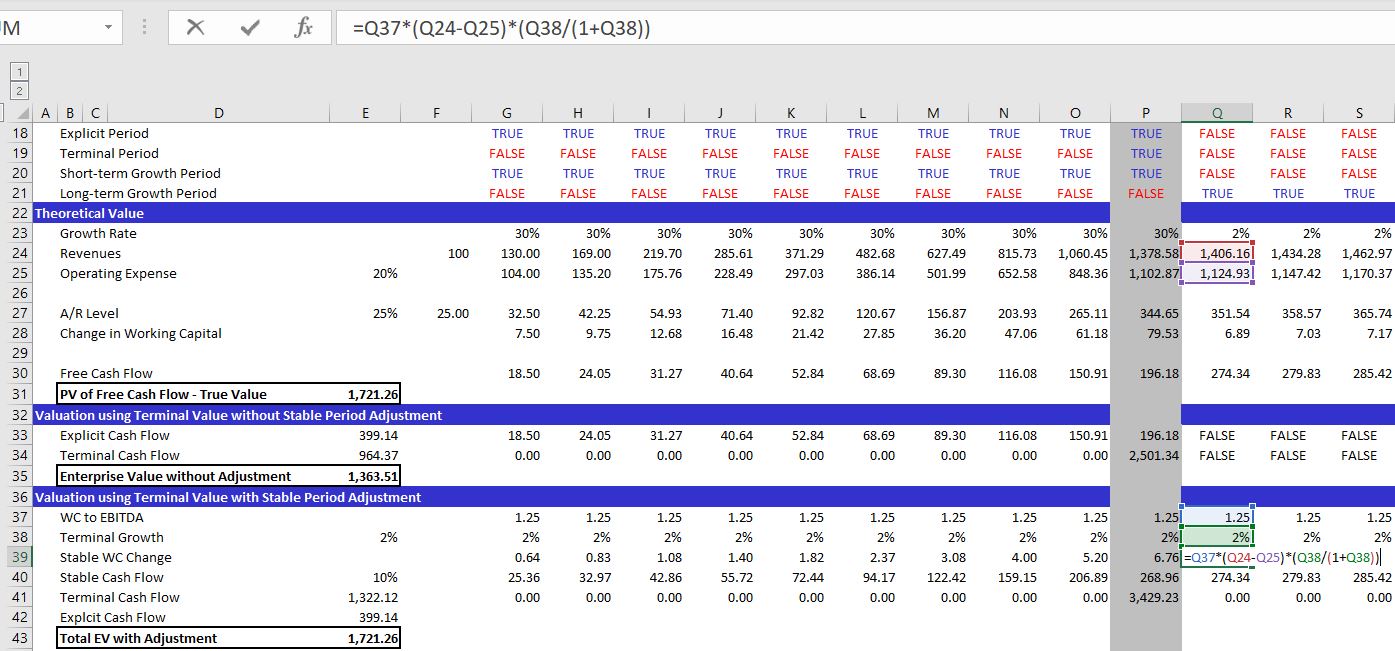

Normalised Cash Flow In Dcf Working Capital Taxes And Stable Roic Edward Bodmer Project And Corporate Finance

How To Use Discounted Cash Flow Time Value Of Money Concepts

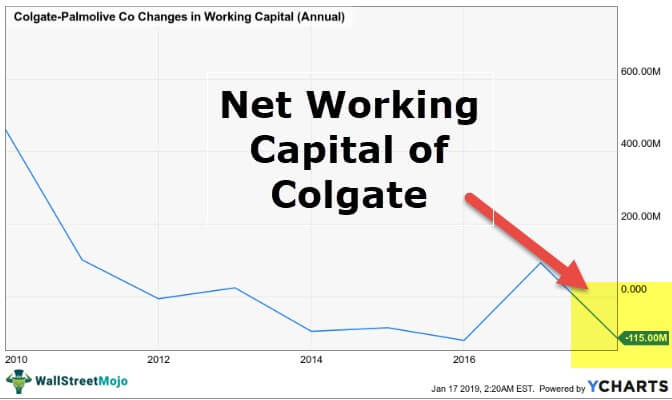

Negative Working Capital Formula And Calculation

Terminal Value In Dcf How To Calculate Terminal Value

Normalised Cash Flow In Dcf Working Capital Taxes And Stable Roic Edward Bodmer Project And Corporate Finance

Discounted Cash Flow Valuation Excel The Spreadsheet Page

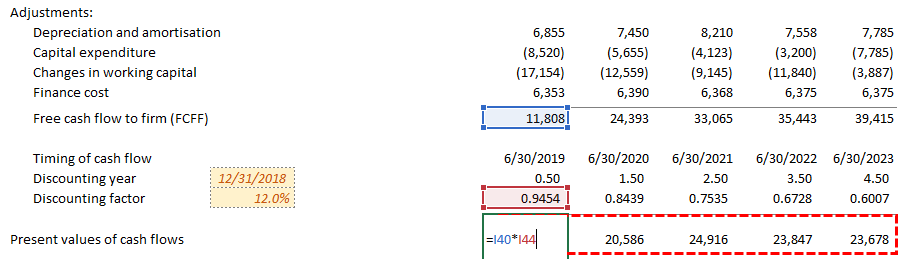

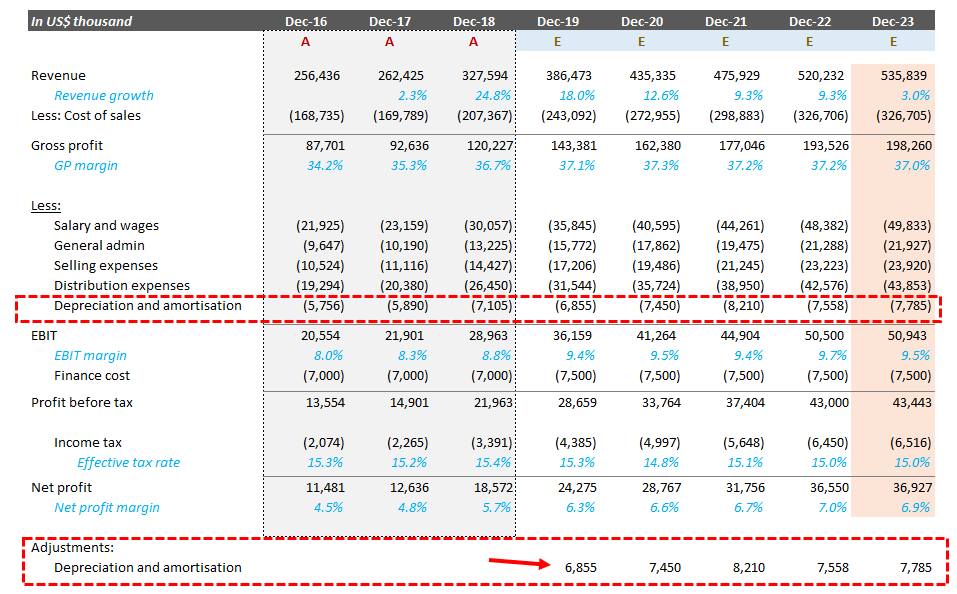

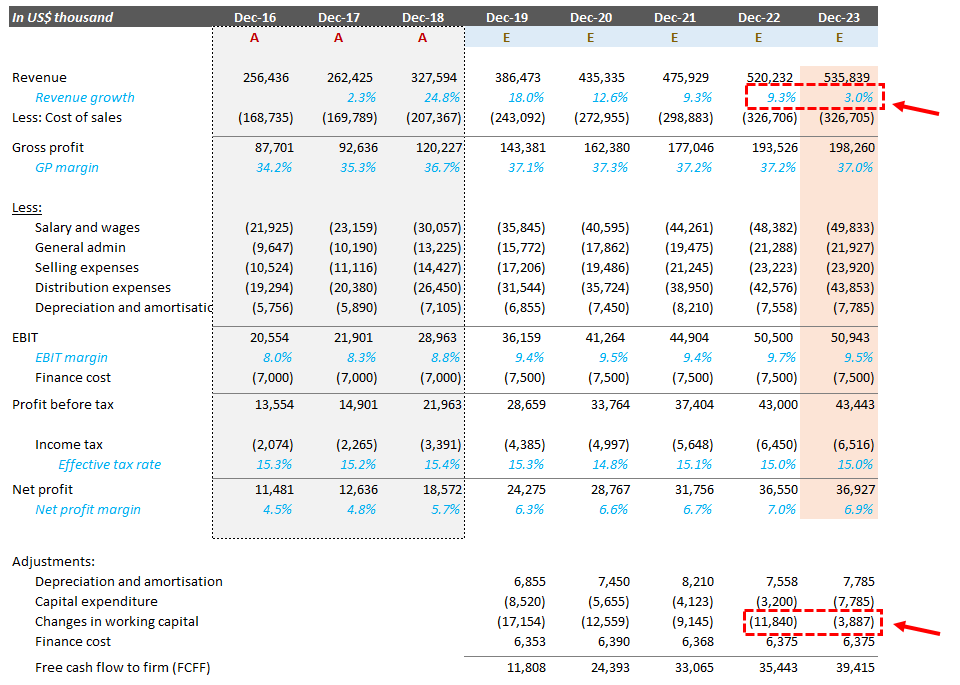

Step By Step Guide On Discounted Cash Flow Valuation Model Fair Value Academy

Step By Step Guide On Discounted Cash Flow Valuation Model Fair Value Academy

Non Cash Working Capital A Critical Component Of Valuation And Fcf

How To Calculate Your Company S Valuation Discounted Cash Flow Dcf Method

Dcf Model The Complete Guide To Building A Discounted Cash Flow Model

The Ultimate Guide To Advanced Discounted Cash Flow Analysis Dcf How To Value A Company Stockbros Research

Change In Net Working Capital From A Metric To The Valuation Of A Firm

:max_bytes(150000):strip_icc()/dotdash_Final_What_Changes_in_Working_Capital_Impact_Cash_Flow_Sep_2020-01-13de858aa25b4c5389427b3f49bef9bc.jpg)

What Changes In Working Capital Impact Cash Flow

Step By Step Guide On Discounted Cash Flow Valuation Model Fair Value Academy